China Brands, Marketing & Consumers

From Baijiu Latte to DIY Liquor Coffee: China’s Coffee Culture Takes a Shot at Coffee + Alcohol Fusion

The recent buzz surrounding the Luckin x Maotai collaboration shows that blending coffee + alcohol might just become the next major trend in Chinese coffee culture.

Published

2 years agoon

PREMIUM CONTENT

China’s coffee culture is brewing up something new as it embraces the fusion of coffee and alcohol. This blossoming trend, currently a hot topic online thanks to the Luckin x Maotai collaboration, is sparking curiosity and discussions about its lasting impact on coffee culture in China.

Would you like a shot with that? Recently, a trend involving the fusion of alcohol and coffee seems to be taking off in China, blending established liquor brands with popular domestic coffee labels.

The concept of mixing alcohol with coffee is relatively new in China, where classics like Irish Coffee never achieved the same recognition as they did in Western countries.

But also, the way in which ‘coffee + alcohol’ is introduced to consumers is different, with brands such as 7-Eleven and Luckin promoting their ‘coffee + liquor shot’ or ‘alcohol lattes.’

As a tea drinking nation, coffee culture is not part of Chinese traditional culture. However, over the past decade, China has witnessed the remarkable growth of a distinct and immensely popular Chinese coffee culture. In this evolving landscape, companies and consumers are continuously finding innovative ways to incorporate coffee into daily city life.

Coffee in China is typically an out-of-home purchase, particularly favored by the middle class (Ferreira & Ferreira 2018, 785). It has become intrinsically linked with modern urban life in China, taking on new cultural meanings related to status, lifestyle, aesthetics, urban communities, and the acquisition of new tastes. Millennials and Gen Z are at the forefront of shaping China’s coffee culture.

The pursuit of unique flavors is a defining aspect of China’s coffee culture, with a strong emphasis on specialty coffee. In fact, Shanghai alone boasts over 7,000 independent coffee houses, surpassing coffee hubs like London or New York (Xu & Ng 2022, 2349). Chinese coffee shops are known for introducing innovative concepts such as fruit-infused coffee, spicy chili coffee, garlic coffee, and liquor-flavored coffees.

Rather than introducing coffee into China’s drinking culture, alcohol is now being integrated into China’s coffee culture, providing consumers with yet another way to enjoy their coffee and explore new flavor experiences.

7-Eleven Blending Coffee with Alcohol

At various 7-Eleven convenience stores in China, you can now purchase a shot of alcohol to go with your coffee. For just 5 yuan ($0.70), customers can add a shot of their preferred liquor, such as Havana or Malibu, to their take-away coffee. It’s also possible to add it to your soda.

7-Eleven DIY counter: adding a shot of Malibu to takeaway coffee. (Image via Xiaohongshu user 今天怎么还没睡).

While we first noticed this option at a Beijing 7-eleven somewhere during the summer of 2023, Radii and Phoenix News reported that the first DYI counter was piloted at a Beijing store in October of 2022.

The counter, that specifically promotes the coffee + alcohol combo, is meant to serve customers who would previously purchase their coffee and then separately buy a full-priced mini bottle of liquor for anywhere in between 20-40 yuan ($2.75-$5.50) for 50ml.

DIY liquor counter at 7-Eleven in Beijing, promoting its “coffee + shot of alcohol” option (Photo by What’s on Weibo).

In late 2022, 7-Eleven in Taiwan also promoted the liquor + coffee combo as it exclusively offered the Hennessy cognac x City Prima coffee “Liquor Latte Set.”

City Prima x Hennessy at 7-Eleven Taiwan (Image via tw.com).

Luckin x Maotai Collab: Introducing Baijiu Latte

While the trend of adding alcohol to coffee seems to be taking off in China, Luckin coffee became all the talk on Chinese social media this week for its collaboration with Maotai (茅台), also known as Moutai, a renowned Chinese brand of baijiu – a type of strong distilled liquor.

Luckin launched the drink on Monday for 38 yuan ($5.20) under the name “酱香拿铁” (jiàng xiāng ná tiě) or “Sauce-Flavored Latte,” soon selling out at various stores and becoming a trending topic online. The ‘sauce’ reference is because of the distinct flavor profile associated with Maotai, often described as having a soy sauce-like aroma (“酱香型”).

The collaboration has become super popular for various reasons, one major one being the unexpected yet exciting combination of two such well-known Chinese brands coming together.

Promotion of the Maotai coffee on Luckin’s Weibo page.

Luckin Coffee (瑞幸咖啡) was founded in Beijing in 2017, opened its first shops in early 2018, and it has seen incredible growth over the past five years. The brand’s primary emphasis lies in providing top-notch coffee at accessible prices in convenient locations. Due to its ubiquity and dominant position in the market, it’s sometimes also referred to as “China’s Starbucks” (“中国星巴克”).

Maotai, made in Maotai in Guizhou Province, prides itself for its 2000-year history and it became the first Chinese liquor to be produced in large-scale production. The strong luxury spirit (53%), known as China’s national liquor, is especially popular among middle-aged and elderly men.

With Luckin being particular popular among China’s younger generations, while Maotai is especially loved among the elder generations, one popular Weibo post about the recent collaboration said: “For young people, it’s their first cup of Maotai, for the elderly, it’s their first cup of Luckin.”

It is also one of the reasons why the trend has become so big this week: many consumers are just curious to try this novel combination, although not everyone likes its special taste.

Trying out the new Luckin x Maotai combo (photos via @互联网欢乐指南).

The blend of coffee with alcohol is really more about the flavor than the buzz; the baijiu-flavored Luckin coffee only has an alcohol content of about 0.5%. One Weibo hashtag related to the question of whether or not people should drive after consuming the drink amassed an astonishing 640 million views (#瑞幸回应喝茅台联名咖啡能否开车#). Despite the very low alcohol content, Luckin still advises that minors, pregnant women, and drivers should avoid consuming the beverage.

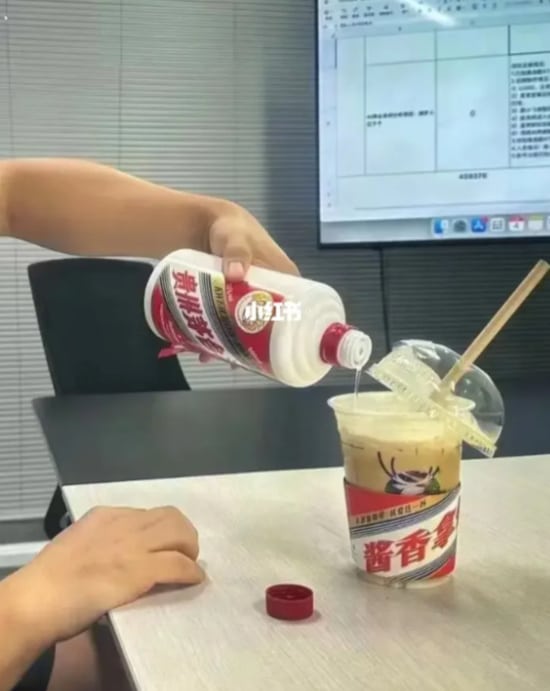

The “Chinese version of Irish Coffee,” image on Xiaohongshu via @謝琦鈦.

Some social media users add some extra Maotai to their coffee themselves, calling it the “Chinese version of Irish coffe” (“中国版的爱尔兰咖啡”).

“Milk Tea for Grown-Ups”

Luckin is not the only Chinese coffee house offering a Maotai-flavored latte. Other Chinese coffee shops have independently introduced their own versions of Maotai coffee, without official partnerships.

In addition to company-driven innovations, consumers are also experimenting with their own coffee + liquor blends. On the social media platform Xiaohongshu, numerous users are enthusiastically sharing their personalized methods infusing coffee with Maotai and various other types of alcohol, including adding miniature bottles of Baileys to Starbucks takeaway coffee.

Image via Xiaohongshu user @潮流情报官.

Others are going beyond the coffee trend, and mix their milk tea or fruit tea with Jameson, Kahlua, or other liquors, turning them into “grown-up milk tea” beverages (成年人的奶茶).

While such practices might receive disapproval in many countries, where daytime drinking and adding spirits to coffee could be seen as indicative of alcoholism and irresponsible behavior, in China, these actions generally lack these negative connotations. Many young people just view it as an innovative way to enjoy new tastes, describing it as “a new trendy way to drink coffee” (or tea).

Is the coffee + alcohol mix a temporary trend, or will it become a permanent part of China’s out-of-home coffee culture? On social media, most people are curious to try it out but they are also not convinced the combination is one to stay.

“I don’t really know the flavor of coffee + alcohol, but judging from their effects – alcohol makes me sleepy and coffee wakes me up – I’m afraid it would mix up my nerves, so I don’t dare to try” one commenter (@无边桃炎) wrote.

“It’s just the taste [of mixing coffee with alcohol] that’s really good – apart from the Maotai Luckin one,” one person responded.

They are not alone; numerous young Chinese internet users are speculating that the recent Luckin collaboration is Maotai’s strategy to appeal to China’s younger generations, who do not necessarily appreciate its distinct flavor. These younger demographics have moved away from the traditional drinking culture in which baijiu plays a significant role.

“It’s just so unpleasant to drink,” others write. “Is it alcohol or is it coffee?” another person wonders: “In the end, it’s actually neither.”

While Luckin’s “Sauce-Flavored Latte” might not secure a permanent place on its menu, it’s clear that the trend of adding alcohol to coffee has gained popularity among China’s younger consumers. With 7-Eleven’s DIY counter offering a variety of sweeter liquors for customers to blend with their coffee, it appears they’ve found the perfect “shot” in this coffee and liquor trend.

By Manya Koetse

with contributions by Miranda Barnes

References

Ferreira, Jennifer, and Carlos Ferreira. 2018. “Challenges and Opportunities of New Retail Horizons in Emerging Markets: The Case of a Rising Coffee Culture in China.” Business Horizons 61, no. 5: 783-796.

Xu, Xinyue, and Aaron Yikai Ng. 2023. “Cultivation of New Taste: Taste Makers and New Forms of Distinction in China’s Coffee Culture.” Information, Communication & Society 26, no. 11: 2345-2362.

Get the story behind the hashtag. Subscribe to What’s on Weibo here to receive our newsletter and get access to our latest articles:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2023 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

Manya is the founder and editor-in-chief of What's on Weibo, offering independent analysis of social trends, online media, and digital culture in China for over a decade. Subscribe to gain access to content, including the Weibo Watch newsletter, which provides deeper insights into the China trends that matter. More about Manya at manyakoetse.com or follow on X.

You may like

China Arts & Entertainment

Controversial Wanghong Livestreamers Are Becoming a Weibo Staple in China

‘Wanghong’ was a mark of online fame; now, it’s increasingly tied to controversy and scandal.

Published

5 months agoon

October 27, 2024

As livestreaming continues to gain popularity in China, so do the controversies surrounding the industry. Negative headlines involving high-profile livestreamers, as well as aspiring influencers hoping to make it big, frequently dominate Weibo’s trending topics.

These headlines usually revolve around China’s so-called wǎnghóng (网红) influencers. Wanghong is a shortened form of the phrase “internet celebrity” (wǎngluò hóngrén 网络红人). The term doesn’t just refer to internet personalities but also captures the viral nature of their influence—describing content or trends that gain rapid online attention and spread widely across social media.

Recently, an incident sparked debate over China’s wanghong livestreamers, focusing on Xiaohuxing (@小虎行), a streamer with around 60,000 followers on Douyin, who primarily posts evaluations of civil aviation services in China.

Xiaohuxing (@小虎行)

On October 15, 2024, at Shenzhen Bao’an International Airport, Xiaohuxing confronted a volunteer at the automated check-in counter, insisting she remove her mask while livestreaming the entire encounter. He was heard demanding, “What gives you the right to wear a mask? What gives you the right not to take it off?” and even attempted to forcibly remove her mask, challenging her to call the police.

During the livestream, the livestreamer confronted the woman on the right for wearing a facemask.

He also argued with a male traveler who tried to intervene. In the end, the airport’s security officers detained him. Shortly after the incident, a video of the livestream went viral on Weibo under various hashtags (e.g. #网红小虎行机场强迫志愿者摘口罩#) and attracted millions of views. The following day, Xiaohuxing’s Douyin account was banned, and all his videos were removed. The Shenzhen Public Security Bureau later announced that the account’s owner, identified as Wang, had been placed in administrative detention.

On October 13, just days before, another livestreaming controversy erupted at Guangzhou Baiyun International Airport. Malatang (@麻辣烫), a popular Douyin streamer with over a million followers, secretly filmed a young couple kissing and mocked them, continuing to film while passing through security—an area where filming is prohibited.

Her livestream quickly went viral, sparking discussions about unauthorized filming and misconduct among Chinese wanghong. In response, Malatang’s agent posted an apology video. However, the affected couple hired a lawyer and reported the incident to the police (#被百万粉丝网红偷拍当事人发声#). On October 17, Malatang’s Douyin account was banned, and her videos were removed.

Livestreamer Malatang making fun of the couple in the back at the airport.

In both cases, netizens uncovered additional examples of inappropriate behavior by Xiaohuxing and Malatang in past broadcasts. For example, Xiaohuxing was reportedly aggressive towards a flight attendant, demanding she kneel to serve him, while Malatang was criticized for scolding a delivery person who declined to interact with her on camera.

Comments on Weibo included, “They’ll do anything for traffic. Wanghong are getting a bad reputation because of people like this.” Another added, “It seems as if ‘wanghong’ has become a negative term now.”

Rising Scrutiny in China’s Wanghong Economy

Xiaohuxing and Malatang are far from isolated cases. Recently, many other wanghong livestreamers have also been caught up in negative news.

One such figure is Dong Yuhui (董宇辉), a former English teacher at New Oriental (新东方) who transitioned to livestreaming for East Buy (东方甄选), where he mixed education with e-commerce (read here). Dong gained significant popularity and boosted East Buy’s brand before leaving to start his own company. Recently, however, Dong faced backlash for inaccurate statements about Marie Curie during an October 9 livestream. He incorrectly claimed that Curie discovered uranium, invented the X-ray machine, and won the Nobel Prize in Literature, among other things.

Considering his public image as a knowledgeable “teacher” livestreamer, this incident sparked skepticism among viewers about his actual expertise. A related hashtag (#董宇辉称居里夫人获得诺贝尔文学奖#) garnered over 81 million views on Weibo. In addition to this criticism, Dong is also being questioned about potential false advertising, which is a major challenge for all livestreamers selling products during their streams.

Dong Yuhui (董宇辉) during one of his livestreams.

Another popular livestreamer, Dongbei Yujie (@东北雨姐), is currently also facing criticism over product quality and false advertising claims. Originally from Northeast China, Dongbei Yujie shares content focused on rural life in the region. Recently, her Douyin account, which boasts an impressive 22 million followers, was muted due to concerns over the quality of products she promoted, such as sweet potato noodles (which reportedly contained no sweet potato). Despite issuing public apologies—which have garnered over 160 million views under the hashtag “Dongbei Yujie Apologizes” (#东北雨姐道歉#)—the controversy has impacted her account and led to a penalty of 1.65 million yuan (approximately 231,900 USD).

From Dongbei Yujie’s apology video

Former top Douyin livestreamer Fengkuang Xiaoyangge (@疯狂小杨哥) is also facing a career downturn. Leading up to the 2024 Mid-Autumn Festival, he promoted Hong Kong Meicheng mooncakes in his livestreams, branding them as a high-end Hong Kong product. However, it was soon revealed that these mooncakes had no retail presence in Hong Kong and were primarily produced in Guangzhou and Foshan, sparking accusations of deceptive marketing. Due to this incident and previous cases of misleading advertising, his company came under investigation and was penalized. In just a few weeks, Fengkuang Xiaoyangge lost over 8.5 million followers (#小杨哥掉粉超850万#).

Fengkuang Xiaoyangge (@疯狂小杨哥) and the mooncake controversy.

It’s not only ecommerce livestreamers who are getting caught up in scandal. Recently, the influencer “Xiaoxiao Nuli Shenghuo” (@小小努力生活) and her mother were arrested for fabricating a tragic story – including abandonment, adoption, and hardships – to gain sympathy from over one million followers and earn money through donations and sales. They, and two others who helped them manage their account, were sentenced to ten days in prison for ‘false advertising.’

Wanghong Fame: Opportunity and Risk

China’s so-called ‘wanghong economy’ has surged in recent years, with countless content creators emerging across platforms like Douyin, Kuaishou, and Taobao Live. These platforms have transformed interactions between content creators and viewers and changed how products are marketed and sold.

For many aspiring influencers, becoming a livestreamer is the first step to building a presence in the streaming world. It serves as a gateway to attracting traffic and potentially monetizing their online influence.

However, before achieving widespread fame, some livestreamers resort to using outrageous or even offensive content to capture attention, even if it leads to criticism. For example, before his account was banned, Xiaohuxing set his comment section to allow only followers to comment, gaining 3,000 new followers after his controversial livestream at Shenzhen Airport went viral. Many speculated that some followers joined just to leave critical comments, but it nonetheless grew his following.

As livestreamers gain significant fame, they must exercise greater caution, as they often hold substantial influence over their audiences, making accuracy essential. Mistakes, whether intentional or not, can quickly erode trust, as seen in the example of the super popular Dong Yuhui, who faced backlash after his inaccurate comment about Marie Curie sparked public criticism.

China’s top makeup livestreamer, Li Jiaqi (李佳琦), experienced a similar reputational crisis in September last year. Responding dismissively to a viewer who commented on the high price of an eyebrow pencil, Li replied, “Have you received a raise after all these years? Have you worked hard enough?” Commentators pointed out that the pencil’s cost per gram was double that of gold at the time. Accused of “forgetting his roots” as a former humble salesman, Li lost one million Weibo followers in a day (read more here).

This meme shows that many viewers did not feel moved by Li’s apologetic tears after the eyepencil incident.

Despite the challenges and risks, becoming a wanghong remains an attractive career path for many. A mid-2023 Weibo survey on “Contemporary Employment Trends” showed that 61.6% of nearly 10,000 recent graduates were open to emerging professions like livestreaming, while 38.4% preferred more traditional career paths.

Taming the Wanghong Economy

In response to the increasing number of controversies and scandals brought by some wanghong livestreamers, Chinese authorities are implementing stricter regulations to monitor the livestreaming industry.

In 2021, China’s Propaganda Department and other authorities began emphasizing the societal influence of online influencers as role models. That year, the China Association of Performing Arts introduced the “Management Measures for the Warning and Return of Online Hosts” (网络主播警示与复出管理办法), which makes it challenging, if not impossible, for “canceled” celebrities to stage a comeback as livestreamers (read more).

The Regulation on the Implementation of the Law of the People’s Republic of China on the Protection of Consumer Rights and Interests (中华人民共和国消费者权益保护法实施条例), effective July 1, 2024, imposes stricter rules on livestream sales. It requires livestreams to disclose both the promoter and the product owner and mandates platforms to protect consumer rights. In cases of illegal activity, the platform, livestreaming room, and host are all held accountable. Violations may result in warnings, confiscation of illegal earnings, fines, business suspensions, or even the revocation of business licenses.

These regulations have created a more controlled “wanghong” economy, a marked shift from the earlier, more unregulated era of livestreaming. While some view these measures as restrictive, many commenters support the tighter oversight.

A well-known Kuaishou influencer, who collaborates with a person with dwarfism, recently faced backlash for sharing “vulgar content,” including videos where he kicks his collaborator (see video) or stages sensational scenes just for attention.

Most commenters welcome the recent wave of criticism and actions taken against such influencers, including Xiaohuxing and Dongbei Yujie, for their behavior. “It’s easy to become famous and make money like this,” commenters noted, adding, “It’s good to see the industry getting cleaned up.”

State media outlet People’s Daily echoed this sentiment in an October 21 commentary, stating, “No matter how many fans you have or how high your traffic is, legal lines must not be crossed. Those who cross the red line will ultimately pay the price.”

This article and recent incidents have sparked more online discussions about the kind of influencers needed in the livestreaming era. Many suggest that, beyond adhering to legal boundaries, celebrity livestreamers should demonstrate a higher moral standard and responsibility within this digital landscape. “We need positive energy, we need people who are authentic,” one Weibo user wrote.

Others, however, believe misbehaving “wanghong” livestreamers naturally face consequences: “They rise fast, but their popularity fades just as quickly.”

When asked, “What kind of influencers do we need?” one commenter responded, “We don’t need influencers at all.”

By Wendy Huang

Follow @whatsonweibo

Edited for clarity by Manya Koetse

Spotted a mistake or want to add something? Please let us know in comments below or email us. Please note that your comment below will need to be manually approved if you’re a first-time poster here.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com

China Books & Literature

Why Chinese Publishers Are Boycotting the 618 Shopping Festival

Bookworms love to get a good deal on books, but when the deals are too good, it can actually harm the publishing industry.

Published

10 months agoon

June 8, 2024By

Ruixin Zhang

JD.com’s 618 shopping festival is driving down book prices to such an extent that it has prompted a boycott by Chinese publishers, who are concerned about the financial sustainability of their industry.

When June begins, promotional campaigns for China’s 618 Online Shopping Festival suddenly appear everywhere—it’s hard to ignore.

The 618 Festival is a product of China’s booming e-commerce culture. Taking place annually on June 18th, it is China’s largest mid-year shopping carnival. While Alibaba’s “Singles’ Day” shopping festival has been taking place on November 11th since 2009, the 618 Festival was launched by another Chinese e-commerce giant, JD.com (京东), to celebrate the company’s anniversary, boost its sales, and increase its brand value.

By now, other e-commerce platforms such as Taobao and Pinduoduo have joined the 618 Festival, and it has turned into another major nationwide shopping spree event.

For many book lovers in China, 618 has become the perfect opportunity to stock up on books. In previous years, e-commerce platforms like JD.com and Dangdang (当当) would roll out tempting offers during the festival, such as “300 RMB ($41) off for every 500 RMB ($69) spent” or “50 RMB ($7) off for every 100 RMB ($13.8) spent.”

Starting in May, about a month before 618, the largest bookworm community group on the Douban platform, nicknamed “Buying Like Landsliding, Reading Like Silk Spinning” (买书如山倒,看书如抽丝), would start buzzing with activity, discussing book sales, comparing shopping lists, or sharing views about different issues.

Social media users share lists of which books to buy during the 618 shopping festivities.

This year, however, the mood within the group was different. Many members posted that before the 618 season began, books from various publishers were suddenly taken down from e-commerce platforms, disappearing from their online shopping carts. This unusual occurrence sparked discussions among book lovers, with speculations arising about a potential conflict between Chinese publishers and e-commerce platforms.

A joint statement posted in May provided clarity. According to Chinese media outlet The Paper (@澎湃新闻), eight publishers in Beijing and the Shanghai Publishing and Distribution Association, which represent 46 publishing units in Shanghai, issued a statement indicating they refuse to participate in this year’s 618 promotional campaign as proposed by JD.com.

The collective industry boycott has a clear motivation: during JD’s 618 promotional campaign, which offers all books at steep discounts (e.g., 60-70% off) for eight days, publishers lose money on each book sold. Meanwhile, JD.com continues to profit by forcing publishers to sell books at significantly reduced prices (e.g., 80% off). For many publishers, it is simply not sustainable to sell books at 20% of the original price.

One person who has openly spoken out against JD.com’s practices is Shen Haobo (沈浩波), founder and CEO of Chinese book publisher Motie Group (磨铁集团). Shen shared a post on WeChat Moments on May 31st, stating that Motie has completely stopped shipping to JD.com as it opposes the company’s low-price promotions. Shen said it felt like JD.com is “repeatedly rubbing our faces into the ground.”

Nevertheless, many netizens expressed confusion over the situation. Under the hashtag topic “Multiple Publishers Are Boycotting the 618 Book Promotions” (#多家出版社抵制618图书大促#), people complained about the relatively high cost of physical books.

With a single legitimate copy often costing 50-60 RMB ($7-$8.3), and children’s books often costing much more, many Chinese readers can only afford to buy books during big sales. They question the justification for these rising prices, as books used to be much more affordable.

Book blogger TaoLangGe (@陶朗歌) argues that for ordinary readers in China, the removal of discounted books is not good news. As consumers, most people are not concerned with the “life and death of the publishing industry” and naturally prefer cheaper books.

However, industry insiders argue that a “price war” on books may not truly benefit buyers in the end, as it is actually driving up the prices as a forced response to the frequent discount promotions by e-commerce platforms.

China News (@中国新闻网) interviewed publisher San Shi (三石), who noted that people’s expectations of book prices can be easily influenced by promotional activities, leading to a subconscious belief that purchasing books at such low prices is normal. Publishers, therefore, feel compelled to reduce costs and adopt price competition to attract buyers. However, the space for cost reduction in paper and printing is limited.

Eventually, this pressure could affect the quality and layout of books, including their binding, design, and editing. In the long run, if a vicious cycle develops, it would be detrimental to the production and publication of high-quality books, ultimately disappointing book lovers who will struggle to find the books they want, in the format they prefer.

This debate temporarily resolved with JD.com’s compromise. According to The Paper, JD.com has started to abandon its previous strategy of offering extreme discounts across all book categories. Publishers now have a certain degree of autonomy, able to decide the types of books and discount rates for platform promotions.

While most previously delisted books have returned for sale, JD.com’s silence on their official social media channels leaves people worried about the future of China’s publishing industry in an era dominated by e-commerce platforms, especially at a time when online shops and livestreamers keep competing over who has the best book deals, hyping up promotional campaigns like ‘9.9 RMB ($1.4) per book with free shipping’ to ‘1 RMB ($0.15) books.’

This year’s developments surrounding the publishing industry and 618 has led to some discussions that have created more awareness among Chinese consumers about the true price of books. “I was planning to bulk buy books this year,” one commenter wrote: “But then I looked at my bookshelf and saw that some of last year’s books haven’t even been unwrapped yet.”

Another commenter wrote: “Although I’m just an ordinary reader, I still feel very sad about this situation. It’s reasonable to say that lower prices are good for readers, but what I see is an unfavorable outlook for publishers and the book market. If this continues, no one will want to work in this industry, and for readers who do not like e-books and only prefer physical books, this is definitely not a good thing at all!”

By Ruixin Zhang, edited with further input by Manya Koetse

Independently reporting China trends for over a decade. Like what we do? Support us and get the story behind the hashtag by subscribing:

Spotted a mistake or want to add something? Please let us know in comments below or email us. First-time commenters, please be patient – we will have to manually approve your comment before it appears.

©2024 Whatsonweibo. All rights reserved. Do not reproduce our content without permission – you can contact us at info@whatsonweibo.com.

What’s on Weibo Chapters

Subscribe

Squat or Sit? China’s Great Toilet Debate and the Problem of Footprints on the Seat

Weibo Watch: The Great Squat vs Sitting Toilet Debate in China🧻

Chinese Netizens Turn to Tim Cook Over Battery Factory’s Illegal Overtime

Revisiting China’s Most Viral Resignation Letter: “The World Is So Big, I Want to Go and See It”

The 315 Gala: A Night of Scandals, A Year of Distrust

Our Picks: Top 10 Chinese Buzzwords and Phrases of 2024 Explained

“Dear Li Hua”: The TikTok/Xiaohongshu Honeymoon Explained

Beyond the Box Office: What’s Behind Ne Zha 2’s Success?

Weibo Watch: Christmas in China Is Everywhere and Nowhere

Weibo Watch: A New Chapter

12-Year-Old Girl from Shandong Gets Infected with HPV: Viral Case Exposes Failures in Protecting Minors

15 Years of Weibo: The Evolution of China’s Social Media Giant

Tuning Into the Year of the Snake

The ‘China-chic Girl’ Image and the Realities of China’s Competitive Food Delivery Market

TikTok Refugees, Xiaohongshu, and the Letters from Li Hua

Get in touch

Would you like to become a contributor, or do you have any tips or suggestions? Get in touch here!

Popular Reads

-

China Insight11 months ago

China Insight11 months agoThe Tragic Story of “Fat Cat”: How a Chinese Gamer’s Suicide Went Viral

-

China Music12 months ago

China Music12 months agoThe Chinese Viral TikTok Song Explained (No, It’s Not About Samsung)

-

China Digital10 months ago

China Digital10 months agoChina’s 2024 Gaokao Triggers Online Discussions on AI

-

China Arts & Entertainment10 months ago

China Arts & Entertainment10 months agoSinging Competition or Patriotic Fight? Hunan TV’s ‘Singer 2024’ Stirs Nationalistic Sentiments